Let us 1st learn and then decide:

Q. What is the Fund name?

ICICI Prudential MNC fund

Q. What does the name

MNC imply?

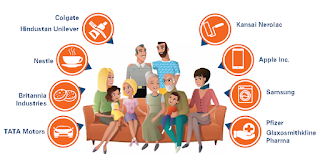

MNC stands for Multi-National Companies, as the name suggests

this fund will invest only in Indian and global MNC’s

Please give some examples

of MNC companies?

- Colgate

- Nestle

- Britannia

- TATA Motors

They might also be investing in companies that do business

in India, however, are not listed on the Indian Stock Exchange, Resident Indians cannot

buy these stocks directly.

Q Why should I invest

in MNC funds?

There are plenty of reason

- Well Established companies

- Global Market exposure and experience

- No Country specific risk

- Good Quality Products

- Technologically stronger than local companies

- Management has a great mix of Global Citizens

Having a worldwide presence, these companies focus and ensure

very high standards of corporate governance.

Having a worldwide presence, these companies focus and ensure

very high standards of corporate governance.

Most of them are cash-rich hence liabilities

is not a major concern. This might result in better returns on equity and consistent

dividend payout.

Q. What is the Investment objective of ICICI MNC fund?

The primary objective of the scheme is to generate long term

capital appreciation by investing predominantly in equity and equity related

securities within MNC space.

Q. What type of Scheme

is it?

MNC fund is an open-ended equity fund

Q. What is open-ended

fund?

Open-ended funds do not have any specific end date, ie. after

the new fund offer date is closed they will start accepting money regularly.

Investors can invest and redeem money without any hassle,

however if redeemed before 365 days, there will be an exit load of 1% applicable.

Plus on any gain, you will have a short term capital gain (Tax 15%)

Plus on any gain, you will have a short term capital gain (Tax 15%)

Q. Who are the fund

managers?

- Anish Tawakley since May 2019

- Lalit Kumar since May 2019

Q. How to Invest?

Contact your Investment Advisor or your Internet banking

should have an option to invest online

Q. How much to invest?

Minimum Investment is INR 5000, maximum is your choice. You

can make a One-time investment or do SIP (recommended)

Q. Do we have similar

funds?

Yes, few funds from different fund houses are listed below:

*Ratios:

NAME |

TOTAL

EXPENSE RATIO

|

STANDARD

DEVIATION

|

ALPHA

|

BETA

|

SHARPE

RATIO

|

Aditya Birla SL MNC Fund

|

1.97 %

|

11.66

|

-7.96

|

0.63

|

-0.23

|

UTI MNC Fund-Reg

|

2.43 %

|

11.09

|

-12.30

|

0.64

|

-0.63

|

If you want to learn how to interpret this data, please read my earlier post "Are you a Mutual Fund Investor?" (👈Link)

*Returns:

NAME

|

6

month

|

1

yr

|

3

yr

|

5

yr

|

10

yr

|

Aditya Birla SL MNC Fund

|

6.18

|

1.73

|

9.26

|

17.81

|

21.25

|

UTI MNC Fund-Reg

|

-0.16

|

-2.34

|

9.61

|

15.15

|

18.92

|

Q. When does the Issue

Open and close?

May 28, 2019 to Jun 11,

2019. Subsequently, this fund will be available like any other mutual

fund.

Q. What are the advantage of MNC

funds?

- Individuals can gain exposure to well-established companies that has a proven business model that has been tested in several countries.

- These companies have weathered the competition in many markets globally and have gained from the experience.

- Most MNC companies offer goods and services of high quality and their products are technologically superior as they have access to the primary know-how.

- They enjoy a good brand image.

- Many of them are led by expats, who have worked in several countries and bring a lot of experience to the job.

- MNCs generally adhere to high standards of corporate governance

Q. What are the disadvantage of MNC fund?

- A key handicap that managers of MNC funds have to deal with is the limited universe of stocks available to them.

- Most of the stocks are trading at a very high valuation, hence SIP is very strongly recommended

- The diversified equity funds in your portfolio may already have many of these stocks

MNC fund might not be a good bet during the high growth period, however, it

works wonderfully during a volatile and depressed market.

The Indian stock market is trading at an all-time high price-to-earnings ratio (PE ratio). It is

advisable to invest in fundamentally strong companies.

Fortunately, this fund offers, some very strong companies in our

portfolio.

PLEASE NOTE:

ONLY INVEST THE AMOUNT, THAT YOU DO NOT NEED AT LEAST FOR 3-5 YEARS!!

Dear Readers,

This blog is my personal attempt to help you. If you found this article to be helpful, kindly share it with your near and dear ones.

I would be very glad to hear your feedback, in fact, it will motivate me to continue my journey of , blog and teach.

Thanks and I wish and hope you make a lot of wealth from your investments.

All the best!! 👍👍👍

I would be very glad to hear your feedback, in fact, it will motivate me to continue my journey of , blog and teach.

Thanks and I wish and hope you make a lot of wealth from your investments.

All the best!! 👍👍👍

Cheers 🍹

Intelligent Investor

Nice article. All the key facts to know are explained in a very simple manner

ReplyDeleteThank you and happy Investing :)

DeleteRemember : Only SIP

Thank you for new update. Please keep posting such..It is useful for investment.

ReplyDeleteDear Tresa,

DeleteYour motivating words are a pleasure to read!

Manish,

ReplyDeleteI want to invest in this fund, can you help me.

Send you an email

Hi,

DeleteThanks for your email.

I have send you a reply

Nice article Manish. Worth spending time on reading this to understand how exactly this MF works and to decide if one should go ahead with investment or not. This will help lot of people out there who are looking for unbiased opinion/reviews of any new fund in market.

ReplyDeleteKeep doing this good work.

Dear Sidhesh,

DeleteThanks for taking time to read and giving me a feedback.

I'm very glad that my article was useful, I will continue to write.

Thank you once again for motivating

Cheers!!

Amazing Article. Keep the simplicity intact

ReplyDeleteDear Deepak,

DeleteThank you and point noted 🤗